As the number of cryptocurrencies has grown tremendously over the previous several years, traders’ need for crypto exchanges to conduct trading has increased. Investors can instantly trade, purchase, and sell cryptocurrencies through these exchanges.

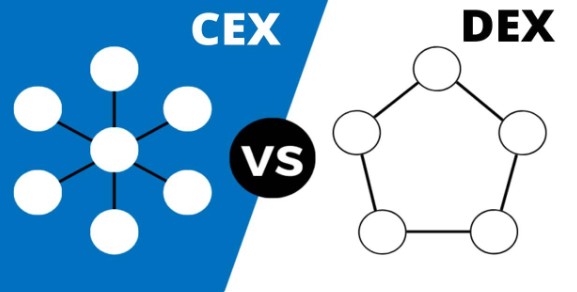

CENTRALIZED EXCHANGES

As its name suggests, centralised cryptocurrency exchanges act as a go-between for buyers and sellers. Virtually the majority of the cryptocurrency transactions take place on centralised exchanges, which offer more reliability.

How does it works?

Users can purchase and sell cryptocurrencies on centralised exchanges for fiat money like the US dollar or digital assets like BTC and ETH. They act as reliable brokers in transactions and frequently act as custodians, preserving and protecting your money.

Benefits of CEX

Because to its accessibility, security, and order management, CEX currently facilitates more than 75% of trading volume, making them a more reliable option for institutions with big volume requirements.

- Provide traders options for buying cryptocurrencies with their local fiat currency and facilitate conversions back to fiat.

- Market makers and quick trade execution enable centralised exchanges to have more liquid markets and provide institutions with a desirable trading environment.

- Centralized exchanges can accommodate a variety of native cryptocurrencies and operate as the authority confirming transactions on their platform, making cross-currency trading simple.

- Provide customer support, such as user-friendly interfaces, to assist traders with any queries they might have.

Disadvantages of CEX

- Centralized exchanges are a prime target for hackers, like other centralised services. Occasionally, despite all precautions, CEXs are compromised

- Users that deposit into centralised exchanges give away custody of their cryptocurrency assets, making it impossible for dealers to retain complete control over their holdings.

- Public access to the movement of money through centralised exchanges is limited. Users occasionally wait until after receiving their transfer before receiving their transaction hash, even when withdrawing.

DECENTRALIZED EXCHANGE

As contrast to centralised exchange, is non-centralized and involves several parties managing the assets. Smart contracts and decentralised apps are used to automate transactions and trades as opposed to conventional centralised exchanges.

This approach is much safer since, as long as the smart contract is made properly, there can be no security breach.

These decentralised exchanges are powered by blockchain-based smart contracts, which are self-executing bits of code. Compared to a centralised bitcoin exchange, these smart contracts provide for better privacy and less slippage (another term for transaction charges).

Yet, even though smart contracts are based on regulations, the lack of a middleman leaves the user on their own, making DEXs appropriate only for experienced investors.

Advantages of Decentralized Exchanges

- It is not necessary for users of decentralised exchanges to transfer their funds to a third party. Because of this, there is no chance that a business or organisation will be hacked, and users may be sure to be more secure from hacking, failure, fraud, or theft

- Decentralized exchanges reduce market manipulation by enabling peer-to-peer cryptocurrency trading, shielding customers from false trading and wash trading.

- Decentralized exchanges provide users with privacy and anonymity by not requiring them to complete know-your-customer (KYC) forms.

Disadvantages of Centralised Exchanges

- Users of decentralised exchanges must keep track of their crypto wallet passwords and keys else their assets would be permanently destroyed and unrecoverable.

- If you want to purchase or sell digital assets using fiat currency, a process known as on and off-ramping, DEXs are best for investors wishing to switch from one digital asset to another.

- The fact that centralised exchanges facilitate nearly all cryptocurrency transactions shows that they are responsible for the vast bulk of trading activity.

- Decentralized exchanges reduce market manipulation by enabling peer-to-peer cryptocurrency trading, shielding customers from false trading and wash trading.

- Decentralized exchanges provide users with privacy and anonymity by not requiring them to complete know-your-customer (KYC) forms.

Disadvantages of Centralised Exchanges

- Users of decentralised exchanges must keep track of their crypto wallet passwords and keys else their assets would be permanently destroyed and unrecoverable.

- If you want to purchase or sell digital assets using fiat currency, a process known as on and off-ramping, DEXs are best for investors wishing to switch from one digital asset to another.

- The fact that centralised exchanges facilitate nearly all cryptocurrency transactions shows that they are responsible for the vast bulk of trading activity.

CEX V/S DEX

| Feature | CEX | DEX |

| Ease of Use | User Friendly | Complicated |

| Security | To prevent hackers, there must be highly rigorous security measures. | There is no possibility of a hack or any other security risk |

| Features | Offering lots of features | Do not have many offers |

| Liquidity | High liquidity | Low liquidity |

| Speed | Requires less time to be executed | Needs longer time |

| Regulation | It has to follow compliance and requires licence from authorities | Do not require any licence |

| Control | The platform holds the levers of control. | Users are in charge of this transaction. |

| Fees | Charges fees for carrying out the transactions | Requires no fee |

| Popularity | Very popular | Not popular |

| Fiat Payment | Yes | No |

Top Centralized Exchanges

- Binance

- Coinbase Exchange

- Kraken

- KuCoin

- Binance.US

- Bitfinex

- Gemini

- Coincheck

- Bitstamp

- Bybit

Top Decentralized Exchanges

- Uniswap (v3)

- dYdX

- Curve Finance

- Kine Protocol

- PancakeSwap (v2)

- DODO (Ethereum)

- Sun.io

- ApolloX DEX

- Uniswap (V2)

- Perpetual Protocol

DEXs improve on CEX’s flaws.

To conduct the transaction more rapidly and affordably than centralised exchanges is one of the main goals of a decentralised exchange. To do this, they eliminate the middlemen who take a cut from transactions on the centralised exchanges in the form of transaction fees.

Uniswap, one of the biggest decentralised exchanges in the world, declares “zero rent extraction.” The exchange tries to protect its consumers from incurring additional charges that benefit intermediaries.

By the end of 2021, Uniswap was charging a transaction cost of 0.05 percent, whereas centralised exchanges like Coinbase, Binance, and Kraken were charging, respectively, 0.2 percent, 0.1 percent, and 0.2 percent.

Final Thoughts

Decentralized exchanges enable users to keep their own assets, offer lower transaction fees, and sidestep some regulatory requirements. The advantages of centralised exchanges, on the other hand, include quick transactions, simplicity, high liquidity, and more.

Decentralized exchanges are subject to liquidity risks just like centralised exchanges are. All financial instruments and assets exchanged on a specific exchange require liquidity. Liquidity, however, continues to be a major problem for decentralised exchanges.